Aligning contractual insurance requirements with perceived risk.

Determining the appropriate level of insurance requirements to include in the contract can be a vexing task. In this article we discuss some key issues and show examples of actual insurance requirements in use for a variety of risk types. The task is somewhat mitigated in the case of tenants or franchisees where a (more or less) "standard" agreement applies to a large population with near-identical levels of risk. But the case with vendors and contractors is an entirely different story and should be predicated on carefully answering a few key questions:

Do you classify risk?

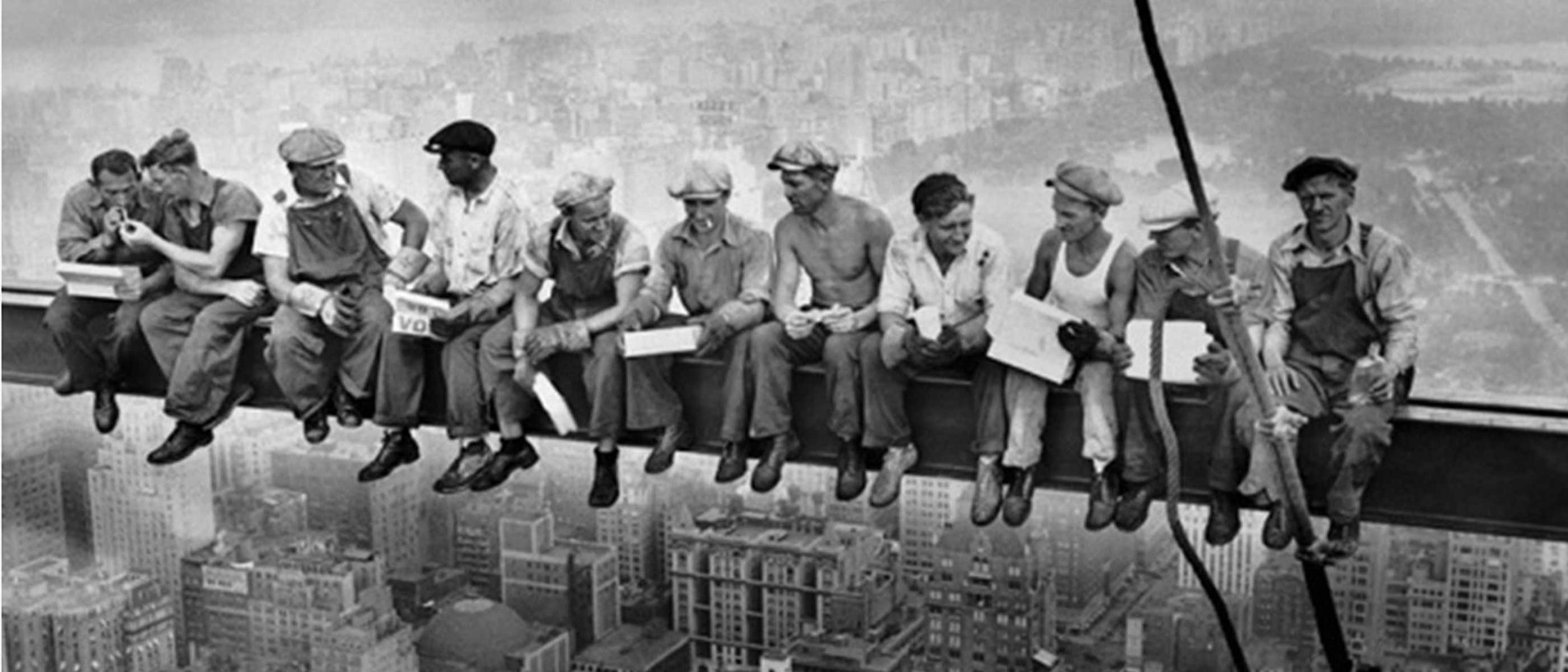

The guys working on the roof of your 40-story apartment building are probably at greater risk than say, a locksmith. Examine the nature of the vendor's work and the tools and equipment needed. We work with companies where more than 100 categories of risk are defined and the insurance coverages required in the contract are matched accordingly. See what other risk managers are doing: Download examples of actual risk classifications.

Do you qualify your vendors?

Supplier Information Management tools provide robust solutions to quickly gain intelligence on your proposed vendor. These online solutions can help identify potential areas of concern by reporting on key areas, such as financial, legal, performance and risk information. Identify other businesses the vendor has worked with and ask questions. Forearmed is forewarned.

Are you an Additional Insured?

Being named on the vendor's insurance policy protects you against claims or efforts of recovery by the vendor's insurance carrier. Nevertheless, some states will allow recovery efforts under their interpretation of "broad liability."

Do you enforce compliance?

The whole exercise is pointless if you don't collect, verify, monitor and enforce the insurance coverages required in the contract. Policy renewal is a common cause of failure – coverages are confirmed during contract inception but there is no follow up thereafter. In some cases, the most effective method of enforcement is withholding payment for services until insurance compliance has been satisfied.

When is enough enough?

Demanding a certificate of insurance is a good start, but many would argue it is not enough. Should you collect the policy endorsements for Additional Insured and Subrogation? What about Primary and Noncontributory? How much can you rely on the contract itself? Ask for too little documentation and you could be in trouble if something goes wrong. Asking too much is an invitation to non-compliance, debate and possible contract revision, project delay and costly legal resources.

The bottom line is there are minimum, intermediate and maximum levels of protection against third-party liability. Some requirements are more specific to one type of risk than they are to another. Some are more burdensome and difficult to satisfy so compliance many suffer. These considerations need to be factored into your risk classification requirements matrix. Unfortunately, one size doesn't fit all and there are no "right" answers, just informed judgment.

Can I do this myself?

Needless to say, if you do not have the resources or expertise in-house to develop and enforce your insurance compliance coverage requirements you need to get a risk management professional to help you. Today's world is far too litigious to ignore this important component of risk transfer.

Please note that this information is not intended to serve as legal advice and is only general information not directed to any particular set of facts.

Back To Blog Stream

Leave a Comment